BEIJING, May 19 (Xinhua) -- The opening-up of China's financial market will bring ample benefits, and it is a necessary step for the country's economic transition, according to experts.

Opening-up in the banking and insurance sectors will help optimize the allocation of financial resources, so that they can better serve the real economy, said Chen Wenhui, vice chairman of China Banking and Insurance Regulatory Commission (CBIRC).

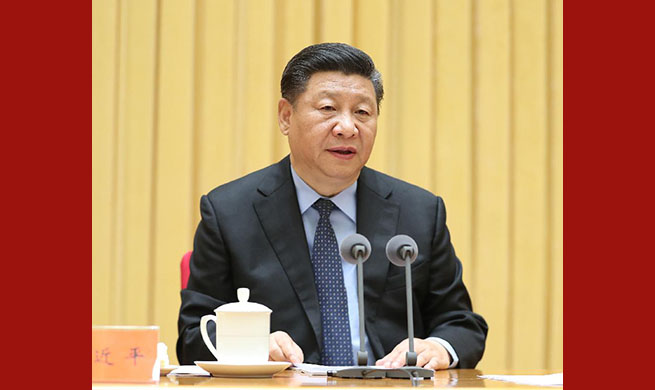

Over the past 40 years, foreign investment has helped with the development of China's banking and insurance sectors in terms of corporate governance and risk management, Chen said at the Tsinghua PBCSF Global Finance Forum, which opened Saturday in Beijing.

China has ample room for further opening-up. At the end of 2017, the total assets of foreign-funded banks accounted for only 1.32 percent of total assets of China's banking industry, far behind the over 10 percent seen in many developed markets and other BRICS economies, according to Chen.

In the process of further opening-up, China should also improve its risk control mechanisms and regulatory framework, he said.

The CBIRC is stepping up efforts to roll out detailed opening-up measures, including easing restrictions on foreign investment and expanding the business scope of foreign-funded banks.

The commission will continue to maintain a tough stance against market irregularities, and create a healthy environment for further opening-up, Chen said.

Chen's opinion was echoed by other experts at the forum, which has the theme "Financial Reform, Opening-up and Stability in the New Era."

China has unveiled a package of opening-up policies in the financial sector regarding market access, business scope and infrastructure, said Zhu Min, former deputy managing director of the International Monetary Fund.

The country's more open position will help promote reform of financial institutions and financial efficiency, he said.

Domestic institutions have advantages in client networks and local resources while foreign entities do better in risk management and efficiency, enabling competition that will change the landscape of China's financial market, he added.

Internationalization of China's financial sector is a necessity as the country's regulatory strength is still incommensurate with its market heft, he added.

"A modern supervision and regulation system can only be established with an open market," Zhu said.